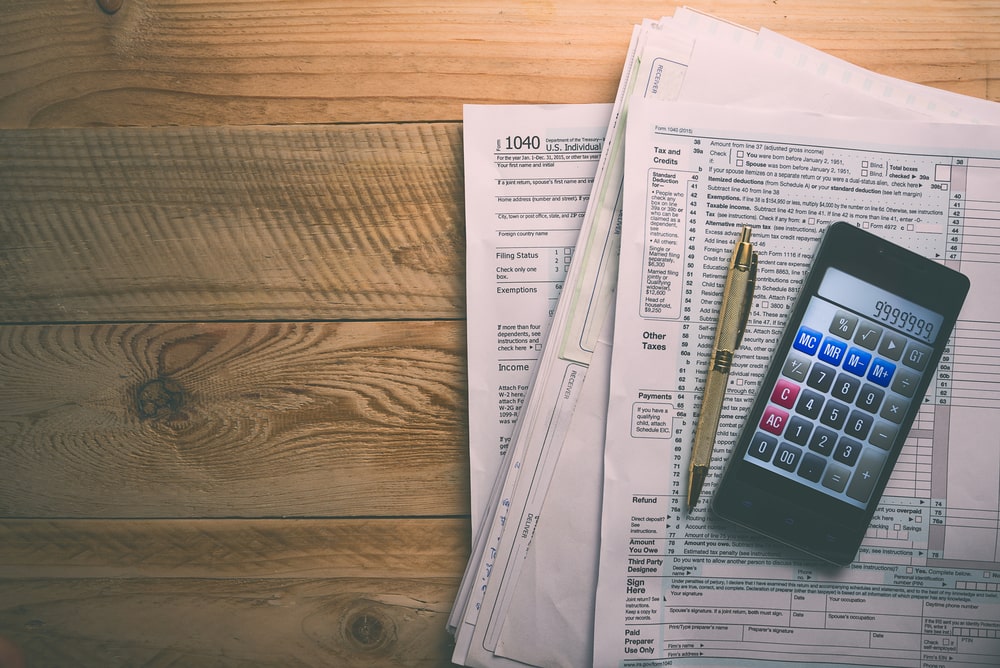

When managing one or multiple rental properties, making money through cash-flow and/or appreciation on your real estate investments is paramount. If you not securing either gain, the performance of your real estate investment becomes questionable. One of the biggest hindrances that come between landlords and net profits are dreaded taxes. There are a number of different taxes that landlords need to pay, depending on the law of their respective states.

Fortunately, there are multiple tax write-offs available for real estate investors and landlords. Today we will have a look at the top 10 tax write-offs for real estate investors and landlords and understand how these write-offs can help real estate investors make more money.

As you must already know, not every tax write-off applies to everyone. You can choose which categories you can claim write-offs for depending on several factors. Without further ado, let’s find out more.

What is rental income?

Before proceeding further, we must understand what rental income is and how its shows in your tax returns. Any amount you receive against someone else living on your property is rental income. It does not mean only the monthly rent that you receive. Any deposit, be it security, advance, or something else, also falls under the category of rental income.

The law of California, and other states also, allow certain deductions to landlords on account of various expenses associated with maintaining a rental unit. Today we will discuss ten of the most common ways to avail tax deductions on your rental property.

1. Interest payments

Interest payments are by far the top tax write-off for landlords and real estate investors. If you are paying the mortgage for the rental property, you can claim a tax deduction under the laws of California. Interest payment goes beyond home loan mortgage payment. If you are paying interest for anything that has something to do with the property’s maintenance or improvement, you can get tax benefits.

Not only is it one of the biggest tax deductions for landlords or rental property investors, but it is also very common. Many people buy property on loans with the aim of tax write-offs. If you are a real estate investor or landlord, you can also benefit from this clause. It is one of the easiest and most effective ways to reduce the burden of tax payments. It also makes it possible for homeowners to make profits even after all repair and maintenance expenses.

2. Depreciation

Real estate and depreciation do not always go hand in hand. Traditionally, real estate investments have only appreciated. That’s why real estate is seen as one of the best appreciating assets, How does then depreciation play a role in tax write-offs for landlords?

When you claim a tax deduction on account of depreciation, you are talking about the physical structure of the house – the building and what’s inside it. It does not take into account the value of the land or the rise in real estate prices. That gives you an avenue for tax write-offs on account of depreciation.

Doing the mathematics to figure out how much you can claim on account of depreciation due to wear and tear is tricky. It involves so many variables and complex formulas that it’s better left to the professionals. Nonetheless, it is one of the best ways for landlords and real estate investors to save money on taxes.

3. Maintenance of the property

Maintenance of a property is the same as giving it a facelift to increase its value. If you are adding a new swimming pool to your property, it cannot fall under the category of maintenance or repair. It is an upgrade, and you cannot claim a tax write-off for it.

However, there are several other areas where you can claim tax write off. Anything that has to do with repairing the existing structure of the house or things inside it falls under repair and maintenance. You can claim a tax write-off on account of repair and maintenance since it is a necessary expense for homeowners.

Every house needs maintenance, and every homeowner has to pay taxes. Figuring out how to save taxes on account of maintenance can be very beneficial for any homeowner or real estate investor.

4. Expenditure on contractors, workers, and staff

People who buy a property with the intention of making it a rental unit often do not live near the property they bought. As a result, they require people who can run the rental property and make sure everything is alright. It can be both a manager or a caretaker, or even multiple of those. No matter whom you employ, you would have to pay them a salary. Any amount you pay as salary to employees with connection to the maintenance of your rental property is eligible for a tax write-off.

However, paying staff is not an expense that landlords have to bear. There are several expenses on account of contractors, handymen, and so on. Any amount you pay to these skilled professionals is also eligible for tax deductions.

It can be very confusing to figure out which types of work are eligible for tax deductions and which are not. An easy rule of thumb is to assess whether the person working is a skilled/specialized worker and whether it pertains to the improvement of your property. If the answers to both these questions are yes, then the expense might be eligible for tax deductions.

Some of these tax deduction laws can be very confusing. If you do not have the time and energy to understand and study the complex mathematics that goes in, you can leave the work to a professional. It will make your work easy and a professional will make sure you get the best of everything.

However, remember that all kinds of home improvement work do not fall under this clause of tax deductions. Any work towards improving the value of the property does not fall in this category, and you cannot avail tax benefits for them.

5. Insurance premium

Some insurance expenses fall under the category of business expenses. You can claim a tax write-off for each of these insurance payments. Some of the most common examples of such insurance payments are personal liability insurance, fire insurance, hurricane insurance, or any other insurance for accidents and natural disasters.

Leveraging insurance to your advantage is a very important skill for homeowners and real estate investors. If you do not understand insurance properly or do not know how to handle it, you will end up paying a lot more tax than you need to. Since every real estate purchase automatically comes with insurance payments, it is very essential to understand it properly. Consider discussing the matter in detail with your insurance agent to make sure you are getting the best deals. Insurance premiums are among the ten best tax write-offs for real estate investors and landlords.

6. Tax deduction against legal and professional services

There are several professional services that landlords may need at various points in time. However, we are not talking about repair and maintenance services here. When you are running a rental property, there are various expenses that you have to bear in terms of payments for professional services. It includes what you pay to lawyers, accountants, and so on.

If you turn your real estate rental into a business entity or LLC, you can avail of tax benefits for the expenses that have gone into it. It includes all professional services that you might need, be it payment of fees to the governing bodies or hiring an attorney for the process.

When you understand how to make the best use of every opportunity you have, you can end up paying a lot less in taxes. Legal and professional services are yet another way to do so.

7. Qualified business income (QBI)

Qualified business income is one of the trickier tax write-off options available to landlords and real estate investors. It is also known as a “pass-through” deduction. The QBI tax break is not for every landlord or investor. It is reserved only for sole proprietors or for those who have made their rental property a business entity (LLC). Qualified business income allows landlords to deduct 20% of the rental income over and above other deductions.

The goal of QBI is to ensure that the same person does not have to pay taxes on rental income twice. Otherwise, they would be taxed twice – once as a business entity and once as personal income. Instead, QBI allows for the rental income to pass through to the owner so that they do not have to pay taxes twice.

8. Payment for utilities

Whether a landlord is paying for some utilities or not depends on the agreement between the owner and the tenants. However, if you are paying for utilities like garbage disposal and water, the expenses of those qualify for tax deductions. However, it is not limited to only water or garbage. Any utility that you pay for is tax-deductible. It can include electricity, routine maintenance, gas, and so on.

Once you understand which utilities you can save tax on, you can include the same in your rental agreement. It is a smart way to keep tenants happy while saving money at the same time.

9. Travel expenses

For travel expenses, you can use the standard mileage rate deduction to calculate how much you claim for tax write-off owing to travel. As we already said, landlords often live considerably far from the location of their rental property. Over time, they have to visit the property multiple times. There can be various reasons behind their visit, be it for routine maintenance or tenant complaint. Every travel expense that’s in connection with your rental property falls under this category. If you can make the most of it, you can save a lot of money in taxes.

10. Marketing and advertising cost

Homeowners regularly put up advertisements in various places to draw tenants. Since marketing expense is a part of business expense, it falls under the category of expenses that are eligible for tax write-offs. No matter where you put up advertisements, you can claim a tax write-off for it.

With that, we conclude our list of top ten tax write-offs for real estate investors and landlords. However, there’s one very important point that has a lot to do with saving on taxes – preserving documents. In many ways, it is the first thing that every landlord should pay attention to.

Preserving documents

As you can see from what we have said until now, you need to have verifiable records for every tax write-off opportunity. Unless you have proof of the expenses you have made, you cannot claim tax deductions under them.

But it is very difficult to keep a tab of every single expense, from a light bulb replacement to a window shade change. To make things easier, you can keep a copy of all the documents on a cloud storage service. If you have a separate folder for it, finding what you need would not be difficult.

At the same time, it is often crucial to preserve the hard copy of the document. The easiest yet most effective to do so is to maintain a dedicated file only for bills and receipts. It’s a rudimentary method, but it works.

If you are in the habit of not keeping receipts and bills, it is time to change it. This habit can make it impossible for you to claim tax deductions against any expense. However, once you get into the habit, collecting bills and receipts is no big deal. All it takes is some practice and awareness.

Final words

Before we end this piece, we want to convey to all readers that only a vacation rental property manager can give you specific advice on how you can save on taxes. The pointers mentioned above are only guidelines. You need a professional who has complete access to all your expenses to accurately understand where and how much you can save on taxes.